The global pandemic caused tremendous economic instability in the world, which led to the foundations of rapid RPA implementation in every other business. Industries turned toward RPA because of its increased role in curbing economic instability and reducing the chances of loss. Similarly, the banking industry is opting for the growing RPA implementation trend. Moreover, with the growing loss in the banking sector due to human errors, adopting smart business solutions such as RPA seems like a profitable venture that can help the banking sector yield maximum profit by cutting the chances of loss.

According to the reports of Gartner, the loss rendered by human errors in the banking sector is about $870,000 annually.

According to McKinsey, in the next two years, machines & software bots will perform 10% to 25% of tasks across various bank functions, thereby expanding the bank’s capacity, by bringing accuracy to the banking processes.

This blog will help you understand what benefits the banking sector can enjoy after implementing RPA.

How can RPA add value to the banking sector?

Robotic process automation (RPA) is used in banking and finance to replace or augment routine human tasks. Its tools can effectively bring end-to-end automation in dealing with the pressing demands of the banking sector. Furthermore, automation in banking processes will improve user experience and the flow of banking services.

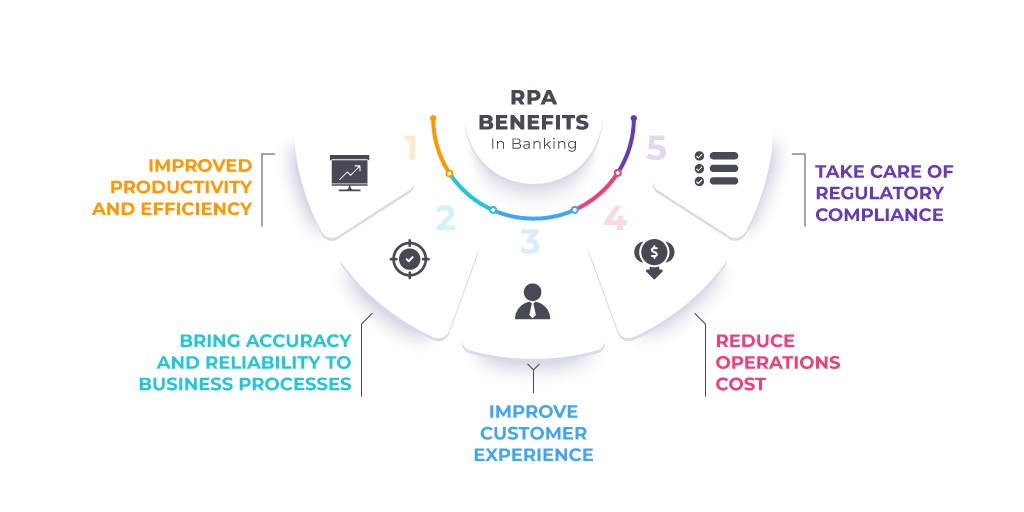

Benefits RPA offers to the banking sector.

RPA can offer multiple benefits to the banking sector. Let’s have a glance at the top 5 most valuable benefits.

- Improved productivity and efficiency

- Bring accuracy and reliability to business processes

- Improve customer experience

- Reduce operations cost

- Take care of regulatory compliance

-

Improved productivity and efficiency

Efficiency in banking processes brings more productivity. The proverb “do more with less” best suits RPA. Although only 29% of corporate controllers use it for financial reporting processes, Gartner predicts that by 2020, 88% will use RPA. Moreover, RPA enables the banking sector to manage operations effortlessly and swiftly, with more accuracy and reduced operations costs.

Furthermore, it streamlines processes that bring more productivity to the banking system. Many banking operations go into automation mode, where staff can only partially validate part of the process.

According to the Gartner report, one-third of finance departments have deployed RPA and utilized the technology for financial reporting, which helps them leave major efficiency gains on the table. Finance departments can save 25,000 hours of avoidable rework caused by human errors after implementing robotic process automation (RPA) in their financial reporting processes.

-

Bring accuracy and reliability to banking processes.

RPA tracks every action and performs functions only when it perfectly meets the requirements. There are many factors that keep affecting the productivity, user experience, and reliability of banking operations. Manual data entry is a major factor contributing to the lowering of quality and delays in banking processes. Moreover, RPA automated the tasks, reducing the chances of errors in processes while ensuring efficiency and improved user experience.

Fewer mistakes in banking processes leave a great impact on user experience. The bots specifically follow the instructions and perform any task according to the legal instructions. AI and machine learning technologies are amalgamated with RPA to perform banking functions with more accuracy and High security.

-

Improve customer experience

Bringing positive changes to the system always helps you achieve a great customer experience. 24/7 service is only possible with RPA implementation, which is important to address the concerns of users 24/7. Customer is the leading force behind the success of any business. Therefore, taking the Initiative to improve the customer experience always proves fruitful. The banking sector deals with a great number of users. Thus, implementing RPA can help you a lot to improve the user experience.

RPA helps the banking sector improve the flow of services by automating most of the tasks, which keeps on improving the user experience. Moreover, automation in most of the processes and efficient responses to consumer queries add value to improve the user experience.

-

Reduce operations cost

The biggest benefit RPA offers to the banking sector is reduced operations costs. By automatic various banking operations, there is no need to hire multiple resources to deal with the regular tasks. Moreover, automation brings accuracy to operations that reduce the chances of loss and contribute to the profit stream. Therefore, in RPA implementation, you will have to bear one-time expenses, but after that, it will save you time as well as your money. Thus, it will be cost-effective and accurate compared to deploying human force in the long run.

Furthermore, robots continuously perform tasks they do not need a break which is good for workflow optimization and gives you better returns at the same cost. RPA Robotic software doesn’t require exclusive coding knowledge to learn the system’s intricacies and operate them optimally; therefore, you do not need a skilled IT team as well.

-

Take care of regulatory compliance.

According to the reports of Bloomberg, more than $321 billion has been spent by banks and financial institutions on compliance operations and fines over the last decade. Compliance operations cost banks nearly $270 billion a year. A bank’s compliance costs account for almost 10% of its operating costs.RPA helps reduce this cost well.

The banking sector has some defined legal regulations where RPA takes great care of regulations. Robots enable banks to perform a high volume of tasks during peak business hours with the same level of accuracy. Moreover, RPA allows banks to manage user data with the defined KYC process.

Driving factors behind the growing RPA implementation

According to PwS, 80% of banking CEOs have concerns about the speed of tech changes. Technology has significantly speeded up the banking process, driving the banking sector to offer improved services. At the same time, workflow optimization, pandemic trends, and high-security demands are driving forces for adopting RPA technology in the banking sector.

Wrapping up

RPA offers plenty of benefits to the banking sector. Its effectiveness improved the profit stream of the banking industry while improving the user experience and workflow. If you are looking to implement RPA technology in your bank, contact BITLogix. Our team will work with you to develop an RPA roadmap, determine the right tools, prepare a proof of concept, conduct governance, set up the team, and test the solution before going live. With more than 15 years of expertise, we provide RPA services to enhance efficiency and accuracy in banking processes. Call our experts right away to get free consultation services.