The insurance industry’s mission is to support customers in times of crisis with prompt, empathetic support. Many of the manual processes in the insurance industry are time-consuming, and legacy applications cannot communicate.

According to the research of Capgemini, current spending on RPA technologies among banking, financial services, and insurance firms (BFSI) is estimated between $50 million and $100 million, which is forecasted to grow between 30% and 60% annually, potentially surpassing $1 billion in the next five years.

This is probably why RPA for insurance has been expected to take the insurance industry to 261.6 billion by 2026. As for RPA alone, the worldwide RPA market revenue is forecasted to amount to over $1202 million by 2026.

Keep reading the blog to learn more about the increasing role of RPA in the insurance sector. This blog will deeply walk you through how RPA is assisting the insurance industry.

Why does the insurance industry need automation?

McKinsey estimated that RPA saved 34 percent time of an employee in data processing. Insurance companies need to use RPA efforts on non-complex, high-volume tasks involving structured data – such as claim processing and form registration – which require manual data entry, retrieval, and gathering. In most cases, these automated systems yielded a very high return on investment (ROI).

It is seen that automation in the insurance industry has been slow, incremental, and often failed to meet customers’ expectations. In order to create innovation in the insurance sector and stand ahead of the competition, insurance companies need to identify high-volume processes and automate them through RPA.

With the help of RPA, process automation will save the time of the workforce, and they can be directed toward more value-added tasks where they can contribute generously to the company’s productivity.

RPA automates most of the insurance industry tasks while cutting costs and improving the flow of processes. Insurance companies can streamline business processes and automate administrative and transactional tasks with RPA.

How is the insurance industry utilizing RPA solutions?

Insurers use RPA for evaluating, structuring, and standardizing data for various purposes, including claims registration, regulatory compliance, business analytics, form registration, and policy cancellation.

Moreover, companies are using RPA solutions for invoice processing, payment management, journal entries, payroll accounting, and a lot of other such cases.

Companies are deploying RPA bots and saving operations costs as bots offer customer support and more efficiency in administration tasks.

Furthermore, companies are using RPA solutions for collecting customer details, copying information across multiple systems, and performing background checks.

Case studies

1. An insurance company was facing issues of unstandardized processes between their different office locations. The process needs to collect data from various steps. They implemented RPA to simplify the process and increase the efficiency of the process from 30 to 40%. Moreover, after RPA implementation, faster response times contributed well to customer satisfaction.

2. Another company implemented RPA in the business process of the robotics center of excellence with the aim of automating business processes, such as illustrating expected benefits and obtaining business user acceptance of automated results. After implementing RPA, the process cycle time was reduced to 75%, with better scalability in business processes. Moreover, RPA helps the insurance company by reducing costs and errors in the process.

How does RPA improve workflow?

Robotics Process Automation (RPA) solutions are based on AI, machine learning, and cloud models that help organizations meet the increasing demand, automating the manual tasks of data entry and a lot more similar tasks. AI-based solutions streamlined the flow of processes while reducing the chances of errors and operations costs.

Insurance is a field with hundreds of manual processes. The majority of operations require human intervention, from creating customer profiles to sending data to underwriters. By taking over these tasks from human personnel, Robotic Process Automation in insurance is improving processes.

What insurance processes can be streamlined through RPA implementation?

- Regulatory compliance

- Claim registration and processing

- Registration of forms

- Policy making and cancelation

- Call center support

-

Regulatory compliance

The insurance industry majorly deals with documentation work. This step demands significant care while dealing with the documents. The staff has to follow strict guidelines while preparing documents. Manual dealing with the same tasks mainly caused errors and breaches of regulatory compliance in preparing documentation. Robotic process automation offers solutions that ensure the preparation of documents while preventing errors and risks.

There is an increased risk of a regulatory violation in insurance due to the multitude of tedious and error-prone processes. Regulatory compliance can be improved through automation since it eliminates the need to devote significant staffing to manual enforcement. Similarly, regulatory report generation, account closure notification generation, and validation of existing customer information are some scenarios RPA can automate in the insurance industry.

-

Claim registration and processing

Manual registration of insurance claims and processing will take a lot of time to process. Automation makes this process smooth and quick. Now, with the assistance of RPA solutions, insurance companies can free up their resources and utilize their potential in other more productive aspects.

-

Registration of forms

Manual registration of insurance claims and processing will take a lot of time to process. Automation makes this process smooth and quick. Now, with the assistance of RPA solutions, insurance companies can free up their resources and utilize their potential in other more productive aspects.

-

Call center support

Bots replace humans and facilitate similar communication with users whenever they need assistance. The bots quickly reply to users and help them solve their problems. Moreover, it offers a quick communication channel that effectively deals with the user’s queries.

-

Policy making and cancellation

Policy making and cancellations involve accessing data and maintaining the data in the record. Furthermore, in an automation solution, starting and ending points of the policy are defined in guidelines that track the ending point of the policy and automatically cancel the policy without the need to cancel the policy manually.

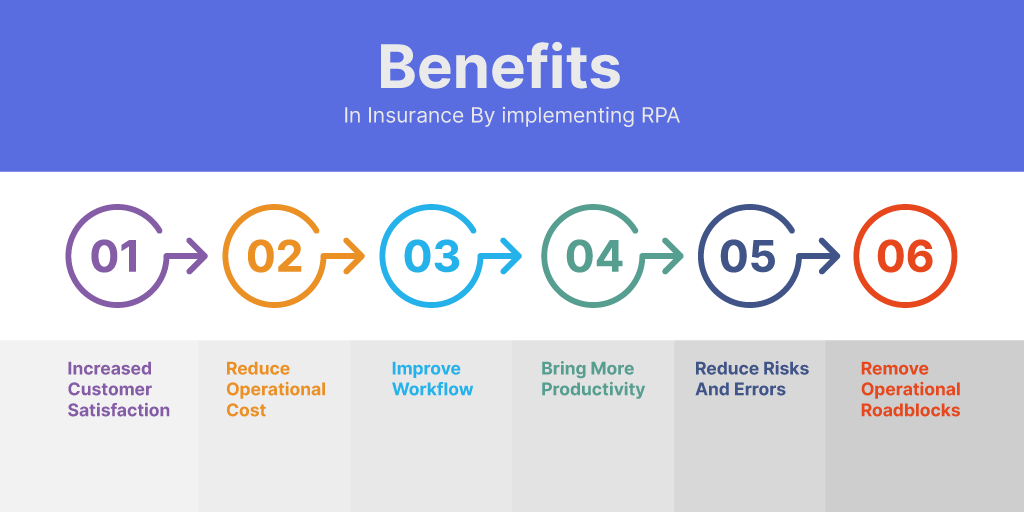

What benefits insurance industry can enjoy by implementing RPA?

Implementing RPA solutions in different insurance sectors will offer your insurance company a lot of benefits. Let’s explore a bit more about the benefits.

-

Increased customer satisfaction

Efficiency and error-free services are always helpful in winning the user’s interest. RPA inures error-free and efficient solutions to users, ultimately improving user experience.

-

Reduce operational cost

RPA can reduce manual operations costs by 25-50% or more, but it also does this while improving service, and compliance typically provides a return on investment in less than a year.

Manual dealings take more time and consume more resources. When it comes to auto solutions, it will not only save time but also save operations costs. Robotic process automation helps you save time. According to the reports of WNS, RPA can cut down the cost of the claims journey by 30%.

-

Improve workflow

With RPA solutions, the process becomes streamlined and smooth. Thus, the user no longer has to face delays in any process. Reductions in cycle times of nearly 80% are not uncommon among those processes where RPA has been implemented. In addition, RPA ensures a level of accuracy, security, and continuity that is higher than that when humans handle the same processes.

-

Bring more productivity

Insurance firms have experienced up to 50% productivity gain after implementing RPA.RPA follows the swift guidelines to perform any task. The insurance industry’s workforce can perform multiple tasks simultaneously without any breaks.

Cranfield and White explained how insurance claims outsourcing and loss adjusting firm managed to implement RPA, leading to a team of just four people processing around 3,000 claims documents a day. Without RPA, running a similar service would involve a team up to 300% larger.

This led to processing time reduction, including one process by over 90%, and uninterrupted operations with multi-skilled robots working on processes 24 hours a day, seven days a week.

-

Reduce risks and errors

Humans can make errors while doing the same task regularly, but RPA cannot. Its applications are error-free, which helps you prevent risks in calculations and data entry tasks. RPA applications have the ability to potentially reduce error rates by 20%.

According to the survey reports of business wire,70% of executives believe RPA lowers manual mistakes and boosts employee engagement, and 60% believe it allows workers to concentrate on more strategic facets of their jobs.

-

Remove operational roadblocks

Organizations sometimes need constant support due to the unavailability of staff or any other factor, but RPA performs tasks without any breaks and delays. Moreover, the productivity of the robotic solution will always remain the same.

How can BITLogix help you?

Bringing automation into the workflow is important to stay competitive in the industry. After COVID-19, automation has significantly gained more space in almost every industry. BITLogix offers the best RPA solutions by configuring your insurance company’s needs. We help you become more productive by injecting our expert RPA strategies. If you are looking to streamline your insurance industry’s processes, we recommend your best solution after a deep analysis of your business needs. Let’s talk to our experts. You are just one call away.